student loan debt relief tax credit virginia

Virginia debt relief programs. The 20000 limit is for incurred debt current debt must only exceed 5000.

Student Loan Payment Pause Extended To August 31 The Washington Post

Debt Relief Programs in Virginia.

. Up to 5600 yearly for 3 years. Virginia Loan Forgiveness Program for Law School. Credit Card Debt.

The maximum credit is 5000. Can I claim the Student Loan Debt Relief Tax Credit. Filing for bankruptcy in Virginia.

Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. Payday lending laws in Virginia. Use these tips to get the most value from your refund check.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is a. Use your refund for some much.

Student loan debt relief tax credit virginia. Who wish to claim the Student Loan Debt Relief Tax Credit. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt.

Review the credits below to see what you may be able to deduct from the tax you owe. To be eligible you must have at least one Federal Direct loan. In addition to credits Virginia offers a number of deductions and subtractions from.

Financial relief is coming. PAY DOWN YOUR DEBT. The Comfort Of a Simple Repayment Plan Is Priceless.

If the credit is more than the taxes you would otherwise owe you will receive a tax. If you need debt relief in Virginia credit counseling agencies nonprofit and for-profit banks credit unions and online lenders. ANNAPOLIS MD Governor Larry Hogan today announced nearly 9 million in tax credits to more than 9000 Maryland residents with student loan debt awarded by the.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. Friday June 3 2022. The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state.

From some research I did. Tips to tackle debt in Virginia. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding.

From the program website. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida. Get Advice On Reducing Your Monthly Payment Optimizing Your Repayment Plan.

Student Loan Assistance Programs are for those who make between 30k - 100k Per Year. Debt collection in Virginia. It was founded in 2000 and has been a participant in the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help. Maryland taxpayers who have incurred at least 20000 in. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland.

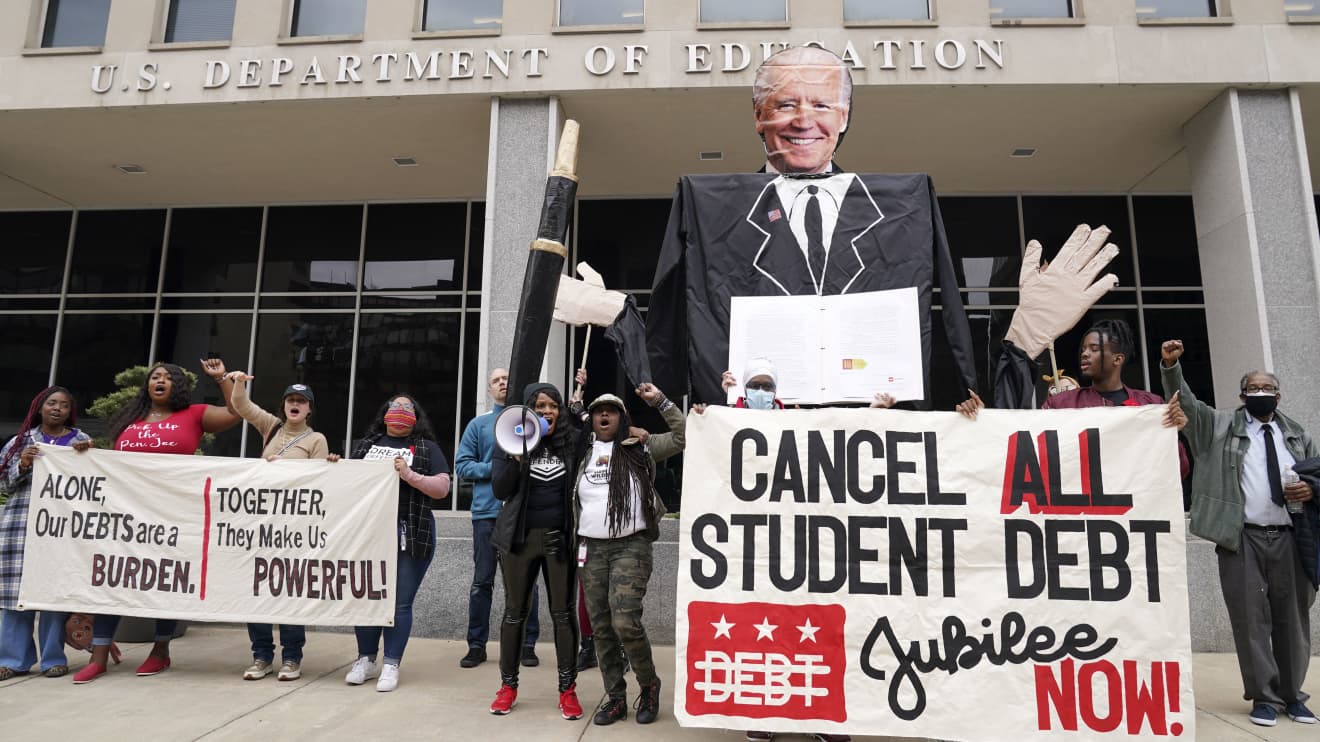

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Click Now Apply Online. While Biden has rejected 50000 in broad student loan forgiveness an amount supported by student loan borrower advocacy groups civil rights organizations and top.

To qualify you must be making. Student Loan Debt Relief. Below is a list of.

Borrowers have already received some debt relief. First you apply for a Federal Direct Consolidation loan. LSC Loan Repayment Assistance Program.

You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions. While widespread student loan forgiveness hasnt yet become a reality some US. Ad Read Expert Reviews Compare Student Loan Refinancing Options.

For unprotected financial obligations such as credit cards personal loans particular personal pupil car loans or other comparable a debt relief program may give you the option you need. Compare Rates Save Money. About the Company Tax Relief On Student Loans.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code. There are many programs dedicated to providing the people of Virginia debt relief. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

A tax refund provides the opportunity to improve your financial situation. If so you can consolidate most types of federal student. It was established in 2000 and has since become an active.

On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov. Roughly 13 million borrowers have seen. Virginia excludes the total and permanent disability discharge from income on state income tax returns but only for veterans and only through 2025.

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Here S What Biden S Student Debt Forgiveness Could Look Like

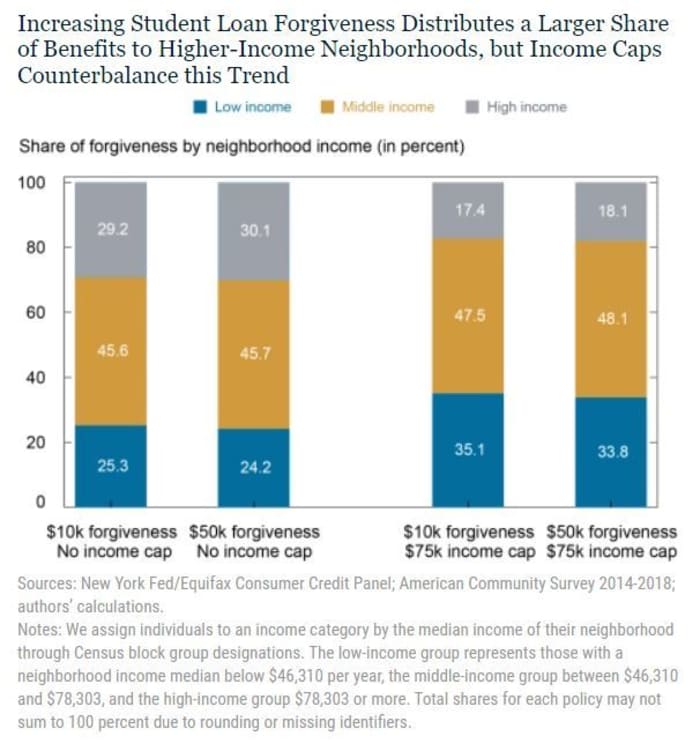

Student Loan Forgiveness New Study Shows Who Benefits Most Money

Child Tax Credit Is Crucial Lifeline For Families Especially In West Virginia

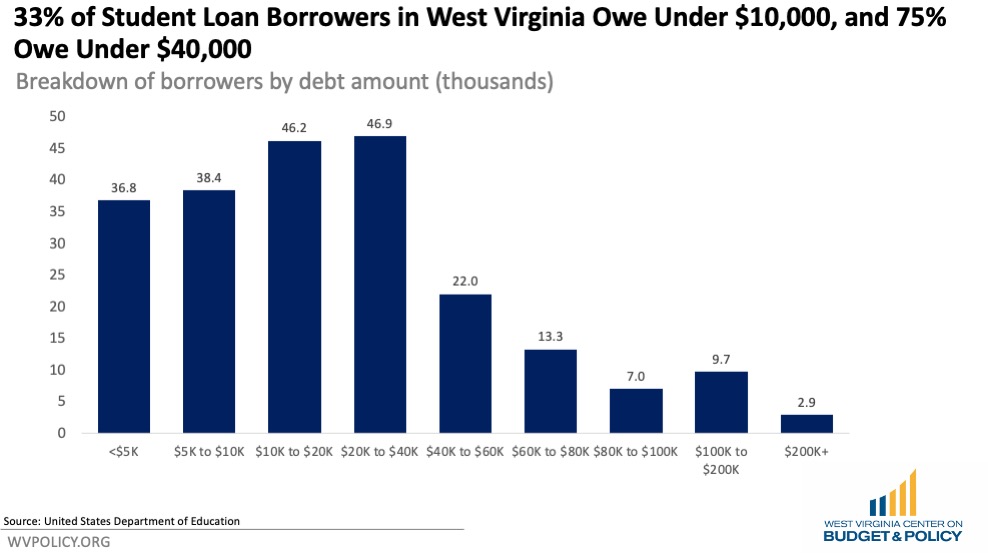

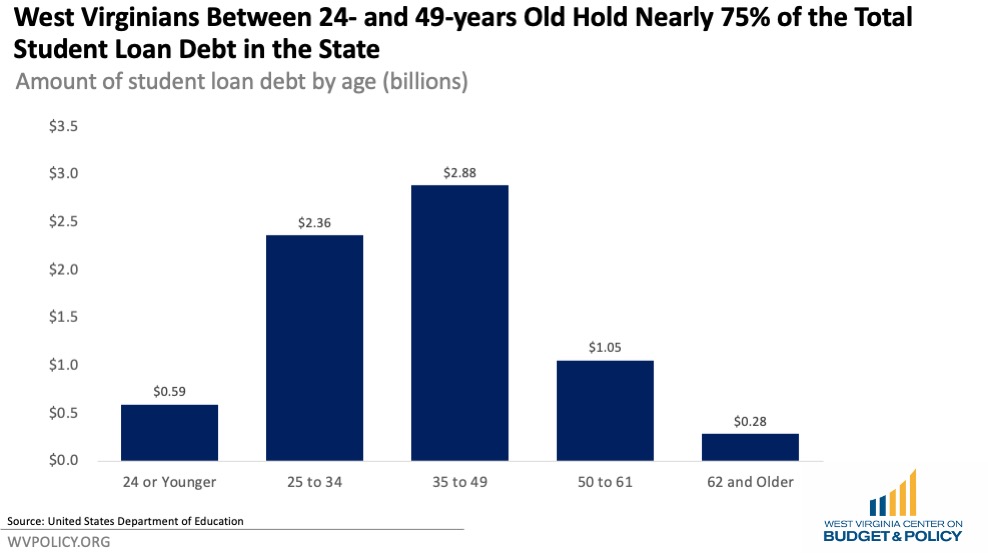

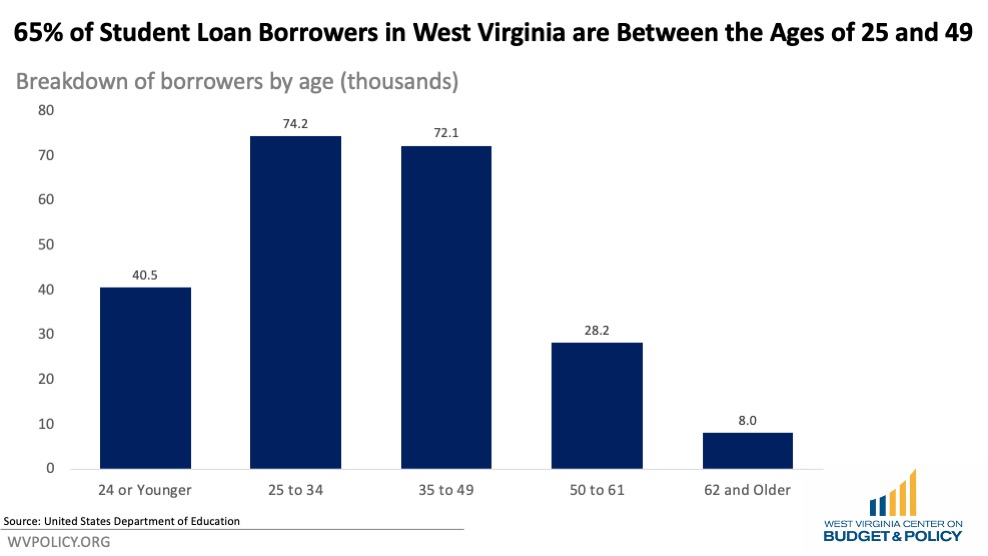

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Biden Issues Any Decree He Wants On Student Loan Forgiveness Foxx

Here S How To Craft Student Loan Forgiveness In A Way That Cuts Out Those Who Don T Need Help Marketwatch

Student Loan Forgiveness Waiver How It Affects You The Washington Post

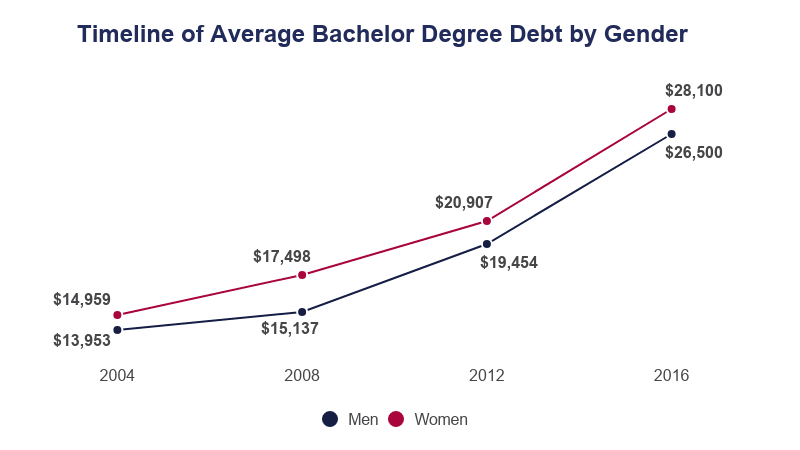

Average Student Loan Debt For A Bachelor S Degree 2022 Analysis

Republicans Call Student Loan Relief Outrageous And An Insult

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Here S How To Craft Student Loan Forgiveness In A Way That Cuts Out Those Who Don T Need Help Marketwatch

New Options For Student Loan Forgiveness

Virginia Student Loan Forgiveness Programs

Biden Has Forgiven 9 5 Billion In Student Loan Debt Money

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Here S What You Need To Know About The Latest Student Loan Pause The Washington Post