unrealized capital gains tax janet

If you hold an asset for less than one year and sell for a capital gain the difference between your purchase price and your sale price will be subject to short-term capital gains taxes. Their last fiscal resort is taxing unrealized capital gains of billionaires.

They Used To Be R Wallstreetbets

Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who.

. If you are in the top tax bracket your long-term capital gains tax rate would be 20 of 200 on your 1000 profit. There is also something called the Net Investment. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could help finance President Bidens now.

Jezcoe January 22 2021 713pm 21. The exact magnitude of the capital gain is 2000 gross proceeds minus 1000 cost basis resulting in a long term capital gain of 1000. This profit is a capital gain.

US Treasury Secretary Janet Yellen has proposed a tax on unrealised capital gains of billionaires. The unsold wealth of the super rich are often transferred. Secretary of the treasury Janet Yellen discussed the subject on CNN.

The amount youll pay in capital gains taxes depends primarily on how long you held an asset. It looks like Janet Yellen would like to tax unrealized capital gains. Itll work the same way cap gains do now.

Janet Yellens recent proposal to tax unrealized capital gains has caused havoc amongst everyday crypto traders. However -I also strongly disagree with that. One of reasons investment in the stock market have continued to be strong is the difference between long term and short term cap gains tax.

In other words if a transaction occurs in which a tax payer does not have the funds to pay a tax generally wouldnt be owed. In the community tax on crypto is a topic of heated debate. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains.

Janet Yellen doesnt care. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2 trillion spending packageTreasury Secretary. Capital gains tax is a.

Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. John Neely Kennedy R-LA said a proposed unrealized capital gains tax will affect millions and millions of middle-class Americans and maul the real-estate market and the market for other long-term assets while appearing on Tucker Carlson Tonight Thursday. Secretary of the treasury Janet Yellen discussed the subject on CNNs State of the Union Yellen explained the concept which aims to tax Americans on unrealized capital gains stemming from liquid assets.

However as most crypto traders know this is not the first attempt of various governments to tax cryptocurrenices. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Not exactly sure how that would work especially if the next year the stock price drops below what you paid for it.

October 24 2021 1056 PM. Read this guide to learn ways to avoid running out of money in retirement. There is a principle in taxation that has been long-standing practice in the United States that financial wherewithal is key to a tax being owed.

Fully tax capital gains but limit deductions to 4000 when capital assets shrink in value and force carryover of the excess. Speaking on CNNs. And then theyll be taxing unrealized gains in wealth taxes.

The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. Short-term capital gains are taxed at your ordinary tax rate. On how it would work it would be on a mark-to-market value.

You lose that if you are now tax the unrealized. Sounds like another dumb idea to make an already complex tax code more complicated. An unrealized capital gains tax would violate this long-standing principle.

The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. Would you then get back the taxes you paid the prior year.

The New Unrealized Capital Gains Tax The Death Of Investing Youtube

Ron Wyden S Capital Gains Tax Proposal Is Insane National Review

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Buyucoin Blog

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

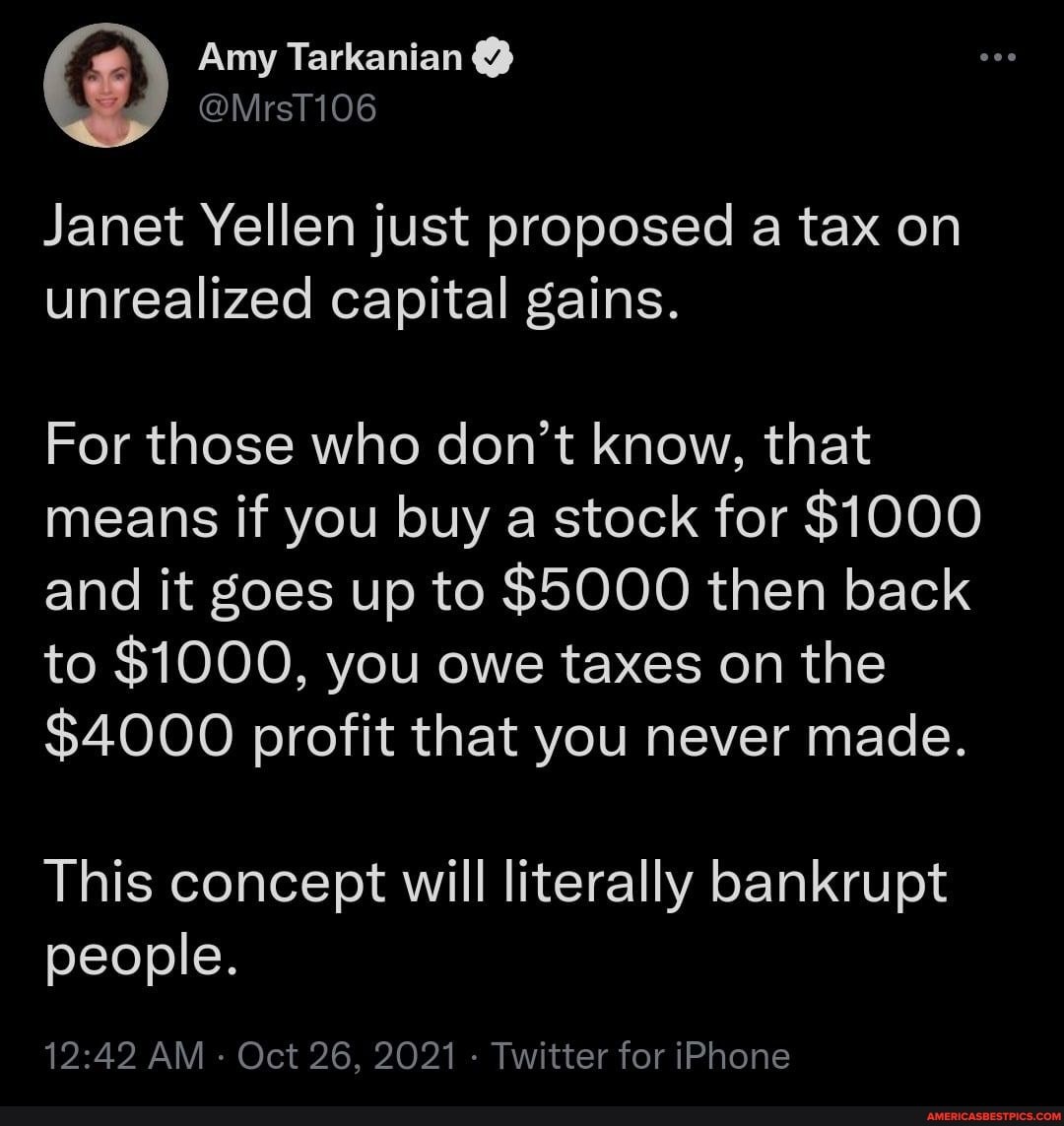

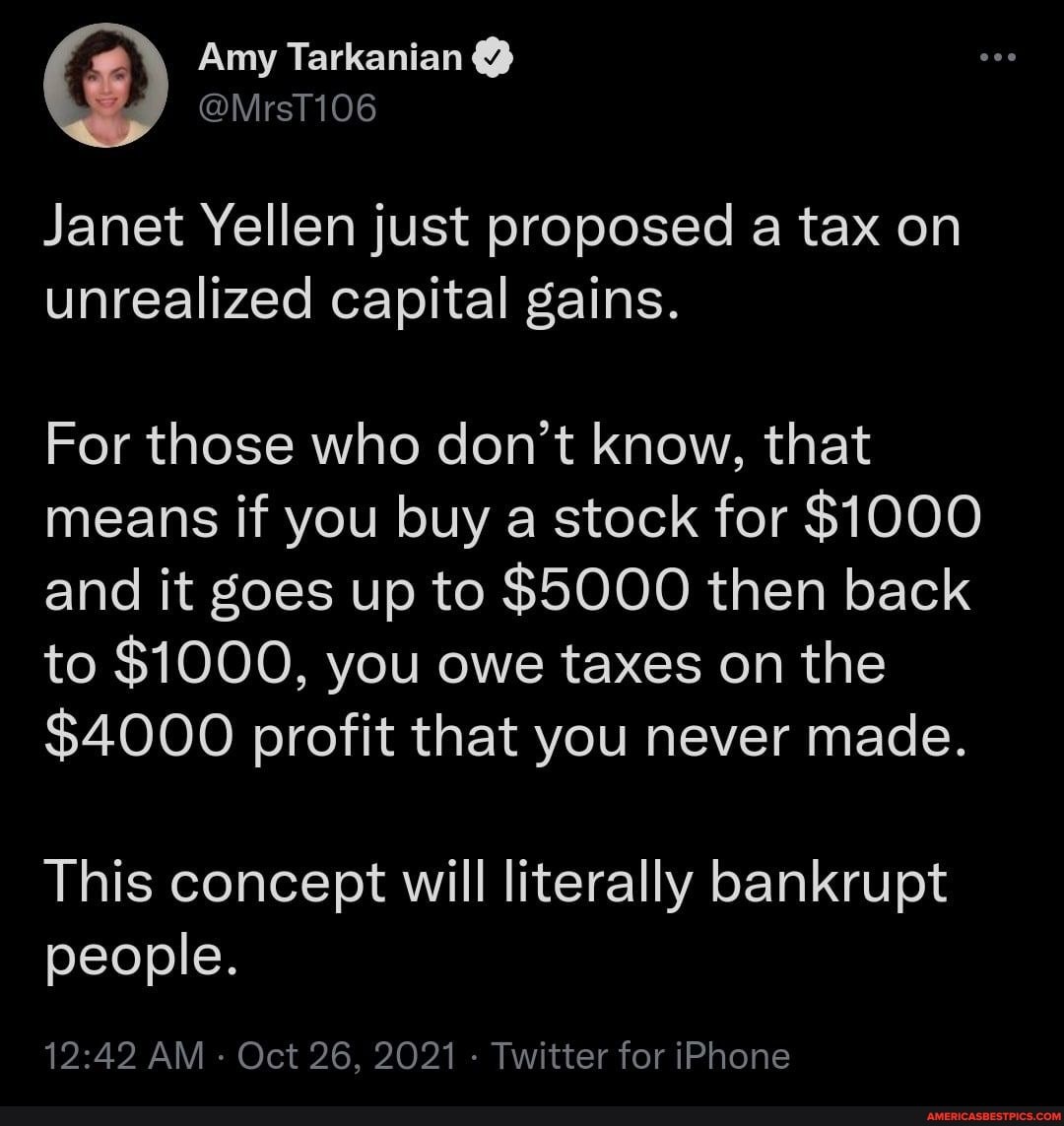

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Janet Yellen It S Not A Wealth Tax It S A Tax On Unrealized Capital Gains Bit Haw

Democrats Terrible Idea Taxing Profits That Don T Exist

Biden S Cabinet Janet Yellen Considers Taxing Unrealized Gains R Accounting

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Cryptowhale On Twitter Us Treasury Secretary Janet Yellen Suggests Imposing A Tax On Unrealized Capital Gains This Means Stock Gains Will Be Taxed Even When They Have Not Been Sold It Also

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Democrats Terrible Idea Taxing Profits That Don T Exist

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

Us Lawmakers Float Tax On Billionaires Unrealised Capital Gains The Market Herald

Twitter 上的bq Prime Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek